- 100% Trusted Platform

Single Platform for All Your Payment & Banking Needs

- Setup in Seconds

- No Credit Card

- Strong security system

Used And Loved By 1M+ User Across 195 Countries

- Featured

How to Establish Credibility With Customers

Financial planning and growth platform for founders

7.42m+ clients experience banking excellence by us. Trusted services, customer focused solutions.

Smart and Simple Online Bank

Get expert advice on selecting the right insurance coverage for your needs.

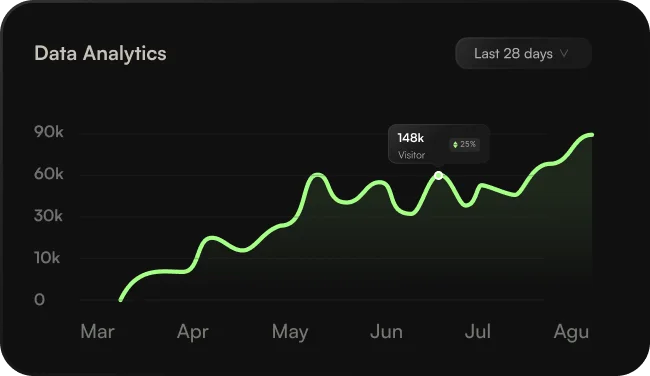

yearly Growth

Income & Expense Tracking

Ideal for exploring the basic functionalities.

Maximizing Benefits With Credit Cards

Fast access to flexible funding solutions to support cash flow and business growth.

Smart and Simple Online Bank

Total Balance

Revenue

Success

Statistic

- Spending

- Arrival

- Support network

Secure and seamless payment solutions

We personalize our support to your individual requirements,

ensuring that you get the help you need.

- Automated Expense Management

- Comprehensive Investment Tracking

- Unlimited website design possibility

- Simplified process

Easy 3-step funding solution

Clean Bank is the future of banking where money can be sent anywhere, anytime and you can hold your own private keys.

01

Download App

It will work for windows, Mac and androids. Go through the summaries for each of your options

02

Create Account

Get up and running in no time by creating a free account. Register only with your email address.

03

Start Banking

Effortlessly finalize your agreement online, ensuring a smooth and prompt funding process for you.

- Support network

Send, Receive, and Swap Money in One Place

We personalize our support to your individual requirements,

ensuring that you get the help you need.

Payment Processing

Develop effective strategies to pay off debts faster and improve your financial health.

Insurance Planning

Insurance planning ensures you have the right coverage to protect against financial risks. It involves selecting policies that safeguard your health, life, property, and income, providing financial security for you and your family.

Investment Tracking

Investment tracking involves monitoring your portfolio's performance over time. It helps you stay informed about growth, returns, and market changes, ensuring your investments align with your financial goals.

Saving Month

Increase of 12% from last month

- Testimonial

What They Are Thinking About Our Digital Banking

"This platform transformed the way I manage my finances. With their tools, I’ve gained confidence and control over my future!"

Michael Brown

SEO Consultant

"As a small business owner, their payment solutions have made transactions effortless and secure. Highly recommend!"

William Harris

Chief Technology Officer (CTO)

"Their financial insights have been a game-changer for my business. I’ve seen improved cash flow and steady growth."

Ava White

Social Media Strategist

"This platform transformed the way I manage my finances. With their tools, I’ve gained confidence and control over my future!"

Michael Brown

SEO Consultant

- Frequently Asked Questions

Have more questions? Don’t hesitate to reach us

What services does your platform offer?

Our platform offers a wide range of financial tools, including budgeting, investment tracking, payment processing, and expert financial advice tailored to your needs.

Is my financial data secure?

Yes, we prioritize the security of your financial data. We use advanced encryption, multi-factor authentication, and strict privacy protocols to protect your information from unauthorized access. Your data is handled with the highest level of security to ensure confidentiality and safety.

How does your payment processing work?

Our payment processing is simple and secure. Once you initiate a transaction, we use a trusted payment gateway to encrypt and securely transfer your payment information. We accept various payment methods, including credit/debit cards and digital wallets, ensuring quick and safe transactions. You’ll receive a confirmation once your payment is successfully processed.

How do I get started with your platform?

Getting started is easy! Simply sign up by creating an account on our platform. Once registered, follow the setup prompts to customize your preferences and explore our features. If you need help, we offer tutorials and customer support to guide you through the process.

What kind of financial advice do you provide?

We offer personalized financial advice covering areas such as investment strategies, retirement planning, insurance needs, tax optimization, and budgeting. Our goal is to help you make informed decisions that align with your financial goals and risk tolerance.

- Frequently Asked Questions

Subscribe to Our Newsletter and Stay Updated

Join our newsletter for updates. Read our Terms